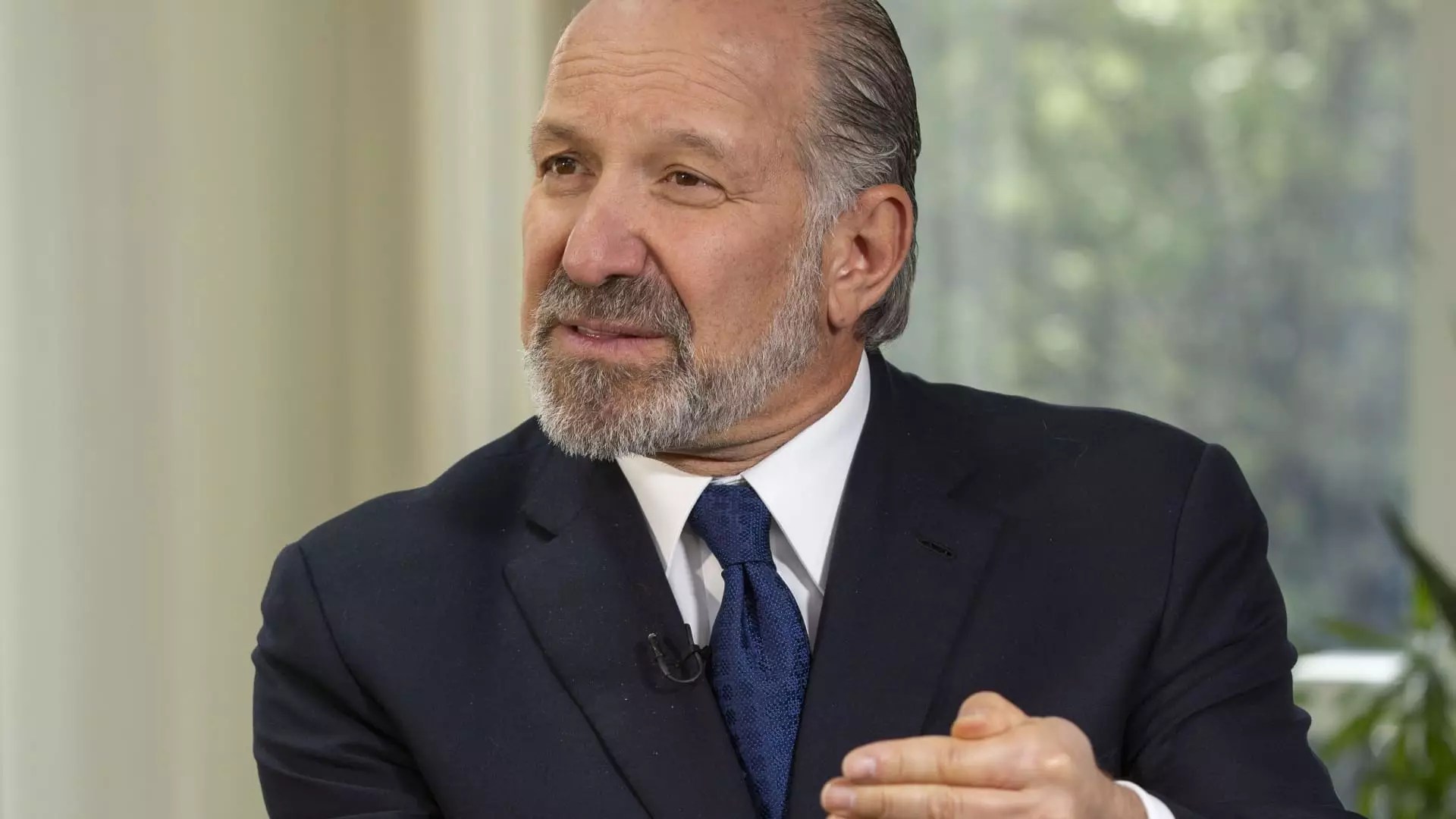

In recent discussions, Commerce Secretary Howard Lutnick has boldly claimed that American taxpayers’ money should come with an ownership stake in Intel, suggesting that the government should convert grants into equity. While safeguarding national interests is essential, framing this as a wholesale demand for “equity for the money” reveals a fundamental misunderstanding of market dynamics and the role of government in a free enterprise system. The push for a non-voting, “for the American people” stake diminishes the importance of private sector innovation driven by competitive incentives, risking bureaucratic meddling that could stifle growth rather than promote it.

The broader problem here is the misconception that government involvement via equity stakes naturally aligns private companies with national economic goals. Historically, excessive government interference has often resulted in inefficiencies, cronyism, and a dilution of entrepreneurial spirit. Intel, as a major player in the semiconductor industry, should be supported through strategic investments, streamlined regulation, and policy simplification—rather than through convoluted equity deals that might erode the company’s agility and undermine investor confidence.

The Failure of Perceived “Free” Grants and the Illusion of Strategic Gain

Lutnick’s critique of the Biden administration’s so-called “free” grants to Intel and TSMC underscores a broader skepticism rooted in the idea that government funding should be earned rather than handed out indiscriminately. Yet, framing these subsidies as “free” ignores the fact that taxpayer money is always a finite resource with competing priorities. Instead of lamenting their generosity, conservative policy should prioritize targeted investments that foster innovation without surrendering strategic control—especially when the stakes involve critical infrastructure like semiconductor manufacturing.

Moreover, equating government funding with the need for equity stakes—particularly non-voting ones—raises questions about the true objectives. If the goal is to ensure national security and technological sovereignty, perhaps the focus should remain on incentivizing private sector leadership through tax benefits, deregulation, and partnership agreements that retain the companies’ independence. The danger of government acquiring stakes that do not translate into actual influence is that it can create a false sense of control while actually hampering operational flexibility.

The Risks Embedded in Rapidly Changing Political Agendas

The proposed involvement of President Trump, who might seek similar equity arrangements with other CHIPS Act beneficiaries, exposes the volatility of politicking around industrial policy. While national strategic interests are justified, using taxpayer money as leverage for political influence or ownership stakes risks eroding the very principles of free enterprise and market competition. It also sets a dangerous precedent—one where investments become tools for political capital rather than genuine economic strategy.

Furthermore, Intel’s struggles to leverage growth opportunities in AI and advanced manufacturing highlight a more systemic issue: the industry’s need for policy environments that foster innovation rather than interfere with business operations through politicized ownership debates. The focus should be on creating a conducive environment for emerging technologies, not on redistributing wealth through government equity grabs that could ultimately diminish investor confidence and long-term competitiveness.

This approach, centered on strategic support rather than underhanded equity demands, aligns better with center-right values—promoting free enterprise, safeguarding innovation, and maintaining government’s role as facilitator rather than shareholder. Moving forward, policymakers should invest in infrastructure and innovation ecosystems that empower companies without entangling them in politicized ownership structures that risk undercutting the very competitiveness they aim to bolster.

Leave a Reply