In the rapidly evolving landscape of retail technology, few innovations have sparked as much intrigue as cashierless checkout systems. Founded in 2016, Grabango aspired to revolutionize the shopping experience by integrating advanced technologies like computer vision and machine learning. The company’s mission was simple yet impactful: to allow customers to shop freely, without the hindrance of traditional checkout processes. However, despite its groundbreaking technology and impressive initial momentum, Grabango has recently found itself unable to rise above the financial challenges facing many startups, ultimately leading to its closure.

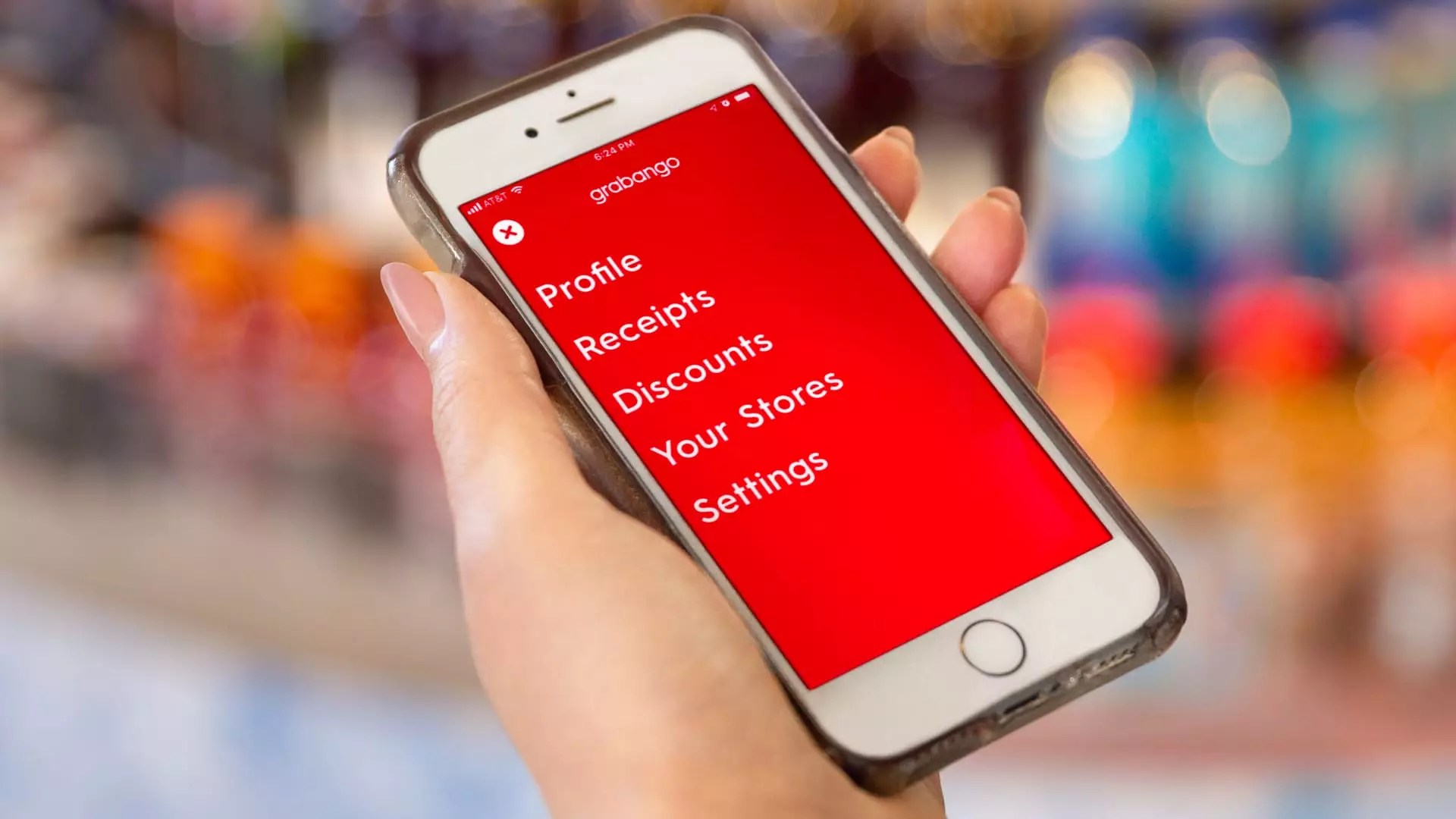

At the heart of Grabango’s innovation was a sophisticated system that tracked items as they were removed from shelves, eliminating the need for manual checkout. Will Glaser, a seasoned technologist and co-founder of the renowned music streaming platform Pandora, spearheaded Grabango’s efforts. With a team of approximately 100 employees, the company managed to secure over $73 million in funding. Their notable fundraising round in June 2021 brought in $39 million, showcasing significant investor interest, particularly from influential firms like Peter Thiel’s Founders Fund.

Despite these achievements, the financial landscape shifted dramatically after Grabango’s peak fundraising success. The onset of tighter market conditions left the startup struggling to secure additional investment. As the IPO market experienced a severe downturn, Grabango’s ambitious goal of going public seemed increasingly unrealistic.

Grabango’s ambition to emulate the success of tech giants such as Amazon was abruptly halted due to a broader industry trend. The venture capital landscape has shifted significantly since early 2022, characterized by a decline in liquidity that made it exceedingly challenging for startups, particularly outside the AI space, to attract necessary funding. The retail technology sector found itself grappling with a dearth of investment opportunities and an overcrowded marketplace, further complicating Grabango’s aspirations for sustained growth.

One of the most telling aspects of this situation is Grabango’s positioning as a direct competitor to Amazon’s well-established Just Walk Out technology. With both players targeting major retailers and convenience stores, Grabango positioned itself as an alternative that distinguished itself through the absence of shelf sensor technology, claiming an edge based on a more refined approach. However, as competitors like AiFi and Trigo entered the arena, Grabango quickly faced intense rivalry in a contest characterized as a modern-day Tortoise and Hare story.

Lessons and Reflections

Grabango’s story serves as a poignant reminder of the volatility inherent in the tech startup ecosystem. The struggles that led to its closure are indicative of a larger trend within emerging tech spaces, where promising concepts must also navigate the harsh realities of market dynamics and investor expectations. The company’s inability to sustain a foothold, despite its technological prowess, echoes a sobering sentiment: innovation alone does not guarantee market success.

Moreover, in a retail environment increasingly dominated by large corporations with extensive resources, smaller innovators like Grabango face insurmountable barriers. This mismatch raises substantial questions about the sustainability of niche startups in a competitive landscape filled with financial pressures and evolving consumer habits.

A Cautionary Tale for Future Innovators

For future innovators within the tech and retail sectors, Grabango’s journey serves as a critical case study. Entrepreneurs must not only focus on developing cutting-edge technology but also remain acutely aware of market conditions and funding realities. Establishing robust partnerships, diversifying funding strategies, and maintaining agility in the face of obstacles are essential strategies for survival.

As the tech industry continues to undergo rapid transformation, the lessons gleaned from Grabango’s rise and fall should prompt reflection and inspire adaptability. The story of this once-promising startup encapsulates both the excitement of innovation and the necessity for prudent business management in a daunting financial landscape. Ultimately, Grabango’s closure may not simply be a narrative of defeat but rather an invitation for future startups to tread thoughtfully into uncharted waters, armed with the wisdom gleaned from the industry’s past.

Leave a Reply