The announcement of Donald Trump Jr.’s appointment to the board of PSQ Holdings has sparked significant activity in the financial markets, illustrating how celebrity influence can drive stock prices, particularly in microcap companies. The jump of 270.4% in PSQ’s stock value following the news shows the volatility and excitement surrounding such high-profile associations. This article will dissect the implications of Trump Jr.’s board membership, the nature of PSQ Holdings, and the broader relevance of celebrity involvement in business ventures.

On the day of the announcement, shares of PSQ Holdings skyrocketed from a previously modest position to a noteworthy $7.63. A market capitalization of $72 million prior to the announcement underscored that PSQ was relatively under the radar, particularly when compared to larger, more established companies. The sudden surge raises questions about the sustainability of such price jumps, raising investor concerns over volatility and speculation versus solid fundamentals.

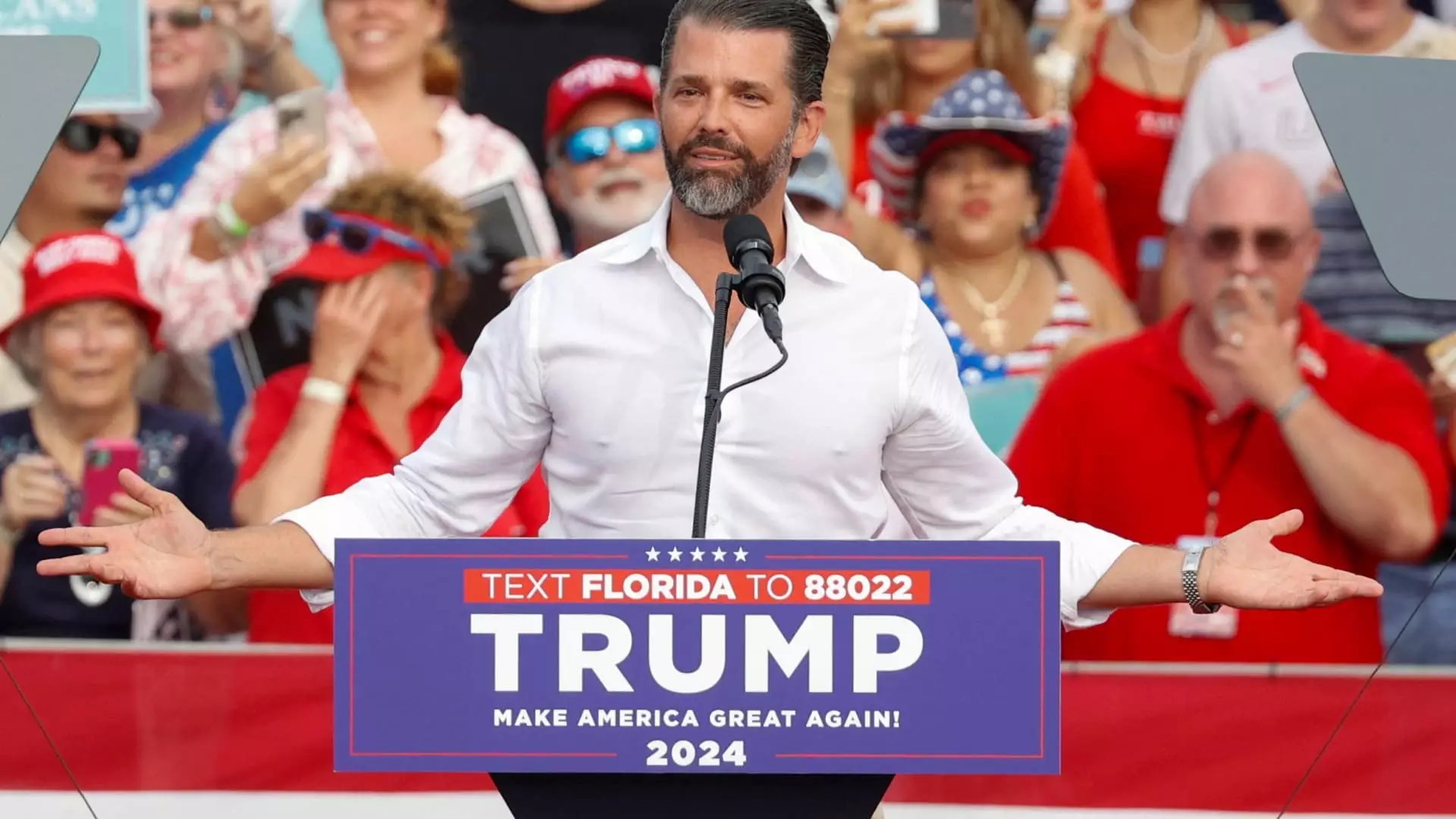

Donald Trump Jr.’s tune in the business landscape indicates a recognition of growing consumer interest in companies that align with conservative ideologies. As the CEO of PublicSquare, Michael Seifert emphasized Trump Jr.’s strategic insight, it leads to a deeper inquiry into how personal branding and political affiliations impact business dynamics in today’s marketplace.

PublicSquare describes itself as a commerce and payments operation devoted to “life, family, and liberty.” These foundational claims resonate strongly with its defined audience but paint a complex picture regarding profitability and growth potential. Despite generating $6.5 million in net revenue for the September quarter, the company faced losses exceeding $14 million. This financial reality raises concerns about how long the growing interest, spurred by high-profile endorsements, can be maintained without a corresponding improvement in financial health.

This relationship hinges on whether PSQ can maneuver through its current losses and effectively harness Trump Jr.’s influence to bolster legitimacy and attract user engagement—a strategy that may prove effective in a marketplace hungry for products and services that echo conservative values.

Trump Jr.’s recent involvement with various companies, including his role at Unusual Machines and 1789 Capital, suggests a strategic pivot toward business ventures that align with his branding as a defender of conservative principles. This trend mirrors a growing phenomenon in the business ecology where celebrities and politicians lend their names and influence to smaller companies, often leading to immediate market reactions.

Such moves beg the question: does celebrity endorsement provide a sustainable pathway for growth, or does it merely serve as a marketing gimmick? Investors must scrutinize whether these companies can maintain their momentum post-reaction, as they often become overly reliant on the fame of board members rather than developing robust business models.

The case of Trump Jr. joining PSQ Holdings exemplifies the dual-edged nature of celebrity influence in corporate structures. While such endorsements can offer a quick boost in visibility and stock price, lasting success will invariably rely on the core business performance of the company. The volatile nature of the market response, particularly for microcap stocks, underscores the essential balance between leveraging influence and demonstrating financial resilience. As PublicSquare moves forward, it will be essential for both the management and the market to evaluate if this strategic decision can lead to lasting positive outcomes.

Leave a Reply