The recent decision by the Federal Reserve to cut interest rates by a quarter point seemed routine on the surface, but the dissenting voice of newly-appointed Governor Stephen Miran signals a deeper ideological clash and a potential shift in monetary policy direction. Miran’s call for a more aggressive half-point cut reflects an unconventional stance, suggesting he prioritizes aggressive economic stimulus over cautious tightening. This divergence exposes an underlying discord within the Federal Reserve — a tug-of-war between traditional prudence and a more interventionist approach, often driven by political influences and perceived economic risks.

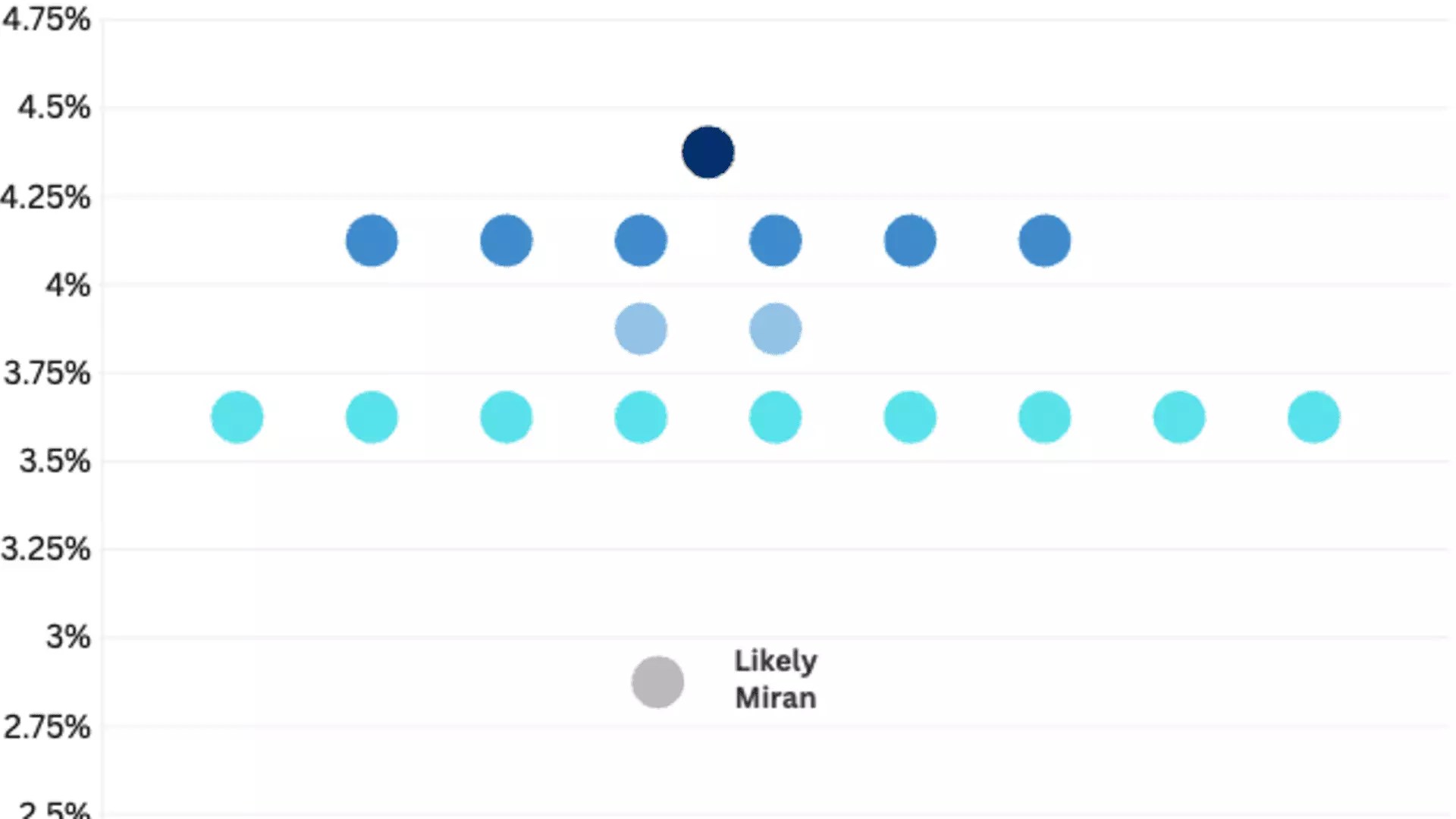

Miran’s position confronts the consensus held by established members like Chair Jerome Powell and fellow governors Michelle Bowman and Christopher Waller. While the latter group appears to follow a more measured, data-driven path, Miran’s dissent indicates a willingness to embrace a more dramatic stimulus strategy—one that temptation suggests may be motivated by the desire to accelerate economic growth or, conversely, to appease political pressures for immediate results. His stance is further accentuated by his background, having been appointed amidst controversy and linked to the Trump administration’s influence on the Fed’s independence. His position on monetary policy is not just about numbers; it’s a signal that the Fed’s autonomy from political meddling remains fragile.

Political Interference: A Double-Edged Sword

Miran’s appointment by President Trump isn’t merely a coincidence; it’s emblematic of a broader attempt by the administration to influence the central bank’s decisions. Trump’s explicit call for significantly lower rates, coupled with Miran’s more dovish stance, risks politicizing the Fed in unprecedented ways. While some argue that governors like Miran are advocating for policies aligned with fiscal stimulus to foster growth, others see this as a dangerous precedent, undermining the Fed’s role as an independent institution dedicated to stable and predictable monetary policy.

The ongoing tug-of-war over the Fed’s direction raises questions about the future of central banking in a politically charged environment. With criticism swirling around recent appointments and the administration’s ongoing efforts to influence key decisions, there’s a tangible risk that monetary policy will become overly susceptible to political whims rather than long-term economic objectives. The fact that Miran is willing to advocate for more aggressive rate cuts suggests he may be influenced, consciously or otherwise, by the political narrative that favors rapid economic expansion—regardless of lingering inflationary risks or market stability.

Implications for Market Stability and Economic Policy

From a center-right liberal perspective, Miran’s dissent could be a double-edged sword. On one hand, aggressive rate cuts might invigorate economic activity in the short term, helping sectors that are struggling and potentially reducing unemployment. On the other hand, this stance ignores the long-term risks: inflation, asset bubbles, and market distortions. Its unpredictable nature could destabilize markets if investors sense that the Fed’s policies are driven more by political pressure than economic fundamentals.

Furthermore, the internal divide within the Fed underscores a significant challenge—how to maintain credibility and stability amidst conflicting signals. While some might argue that a more hawkish stance, like that of Powell and other governors, provides stability, Miran’s more dovish approach threatens to create volatility by signaling uncertainty about future policy paths. His more radical stance exemplifies the growing influence of political ideology in what is traditionally a technocratic field.

In essence, Miran embodies a more interventionist and populist approach that could shift the balance away from conservative monetary discipline toward a future where economic policy is more reactive and less predictable. For those of us committed to a balanced, center-right economic ideology, this raises concerns about whether the Federal Reserve’s independence is genuinely resilient or merely a façade that political forces can still manipulate. As the debate intensifies, it’s crucial to recognize that the real power behind these policy decisions extends beyond mere economics; it is a reflection of ongoing political struggles that threaten to redefine the fabric of American monetary policy.

Leave a Reply