The music industry is in a constant state of flux, with entities like Reservoir Media adapting to the rapid changes within it. With a diversified portfolio that spans music publishing, recorded music, and rights management, Reservoir Media stands at the forefront of this dynamic market. However, as challenges arise, especially related to financial performance and stock market perceptions, a critical evaluation of its strategies, leadership, and market positioning becomes necessary.

At its core, Reservoir Media operates through two significant segments: Music Publishing and Recorded Music. The Music Publishing segment focuses on acquiring interests in music catalogs, which generate revenue through royalities, while also signing songwriters to agreements that expand its catalog. In contrast, the Recorded Music segment aims to discover and market recording artists, acquiring sound recording catalogs to diversify its offerings. This dual approach allows Reservoir to leverage both new talent and established classics, echoing timeless compositions by luminaries like Joni Mitchell and John Denver. With over 150,000 copyrights and 36,000 master recordings in its portfolio, Reservoir is strategically positioned to capitalize on the continuously evolving music consumption trends.

Despite the promising structure of its business model, Reservoir has struggled with its stock performance since going public through a Special Purpose Acquisition Company (SPAC) in mid-2021. At its inception, the company entered the market at an optimistic valuation, but it has since experienced a notable decline in share price. This discrepancy between market expectations and actual performance needs to be scrutinized, particularly in light of the company’s solid year-over-year growth figures that include a gross profit increase from $47.39 million to $89.38 million since its first earnings report.

A significant part of Reservoir’s revenue derives from the burgeoning subscription streaming market, which has grown substantially in recent years. The industry saw a remarkable 11.2% growth in 2023, signifying a lucrative avenue for music catalog owners. Streaming and downloading services currently account for around 54.17% of Reservoir’s revenue, indicating the critical nature of this segment.

However, the reliance on streaming revenue presents unique challenges. As subscription models evolve, artists and producers must continuously adapt their strategies to maintain relevance. Reservoir’s catalog consists predominantly of seasoned artists, which might provide stability but could also limit explosive revenue growth. Without the potential for rapid increases in streaming from newly popularized artists, Reservoir might find its revenue streams stunted over time.

Amidst its financial struggles, Reservoir Media has caught the attention of activist investor Irenic Capital, which holds an 8.14% stake in the company. Irenic is advocating for a strategic review and the formation of a special committee to explore potential sale opportunities. This move raises essential questions about the long-term viability of Reservoir as a public entity.

While activist investors typically lead aggressive campaigns for immediate returns, Irenic’s approach seems to value collaboration with the existing management. The presence of influential stakeholders and their vested interest in maintaining the integrity and viability of Reservoir suggests that immediate liquidation is not necessarily the end goal—a refreshing perspective that aligns with the company’s incremental growth strategy.

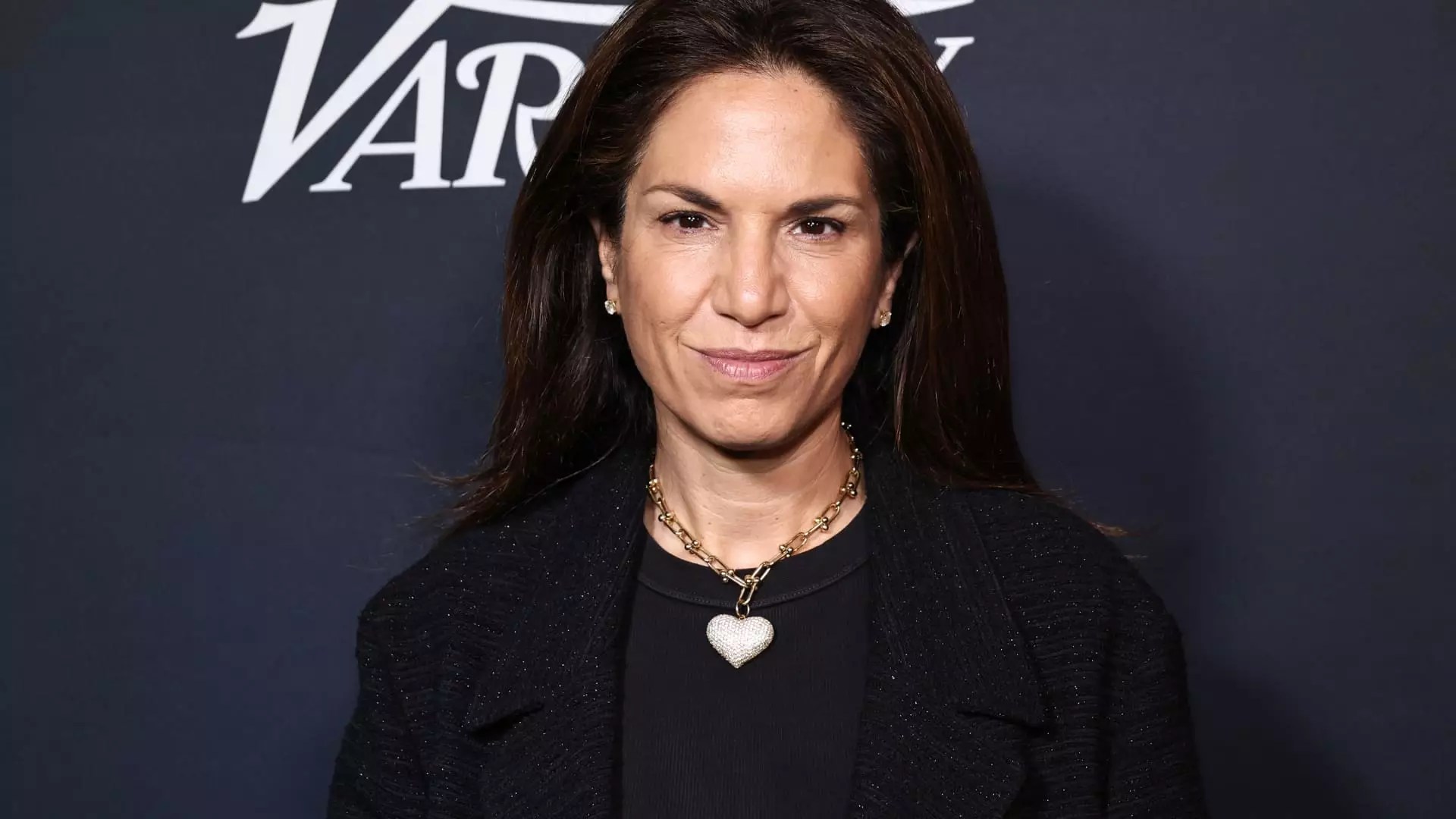

However, the criticism surrounding “sell the company” activism as short-sighted is pertinent here. Given Reservoir’s inherent nature as a collector of royalties, one could argue that maintaining a stable operational structure—complemented by the leadership of CEO Golnar Khosrowshahi, who holds a robust 44% stake—might be more beneficial in the long run than a dramatic sell-off.

The market’s reaction to Reservoir’s declining stock price has prompted speculation about its future direction—whether the company will pursue opportunities for strategic mergers and acquisitions or position itself as an attractive target for acquisition. The precedent set by acquisitions in the sector, such as the buyout of Hipgnosis by Blackstone at significant multiples, illustrates that there is indeed interest in such music portfolios.

However, with Khosrowshahi at the helm, it remains unclear whether she would willingly part with her influential position or nurture Reservoir’s growth from within. Given her track record and strategic insights, investors may prefer continuity over disruption, suggesting that Reservoir is more likely to pursue growth autonomously, potentially making it a coveted asset for private equity firms.

As Reservoir Media charts its course through the complex waters of the music industry, stakeholder engagement, innovation, and a deep understanding of market pitfalls will be crucial. Balancing the demands of being a public company against the need to remain competitive in a rapidly evolving landscape poses challenges yet also offers opportunities for strategic maneuvering. Ultimately, the company’s ability to leverage its vast catalog combined with prudent management will determine whether it becomes a thriving independent entity or a target in the fervent world of music industry investment.

Leave a Reply