Tesla’s recent showcase of its Cybercab concept vehicle marked a pivotal moment, aimed at propelling the narrative of autonomous driving to the forefront. However, the event, headlined by the charismatic CEO Elon Musk, has drawn criticism from investors who expected substantial updates regarding the company’s advancements in self-driving technology. The outcome resulted in a notable drop in Tesla’s shares, reflecting a growing uncertainty surrounding the company’s trajectory in the competitive electric vehicle market.

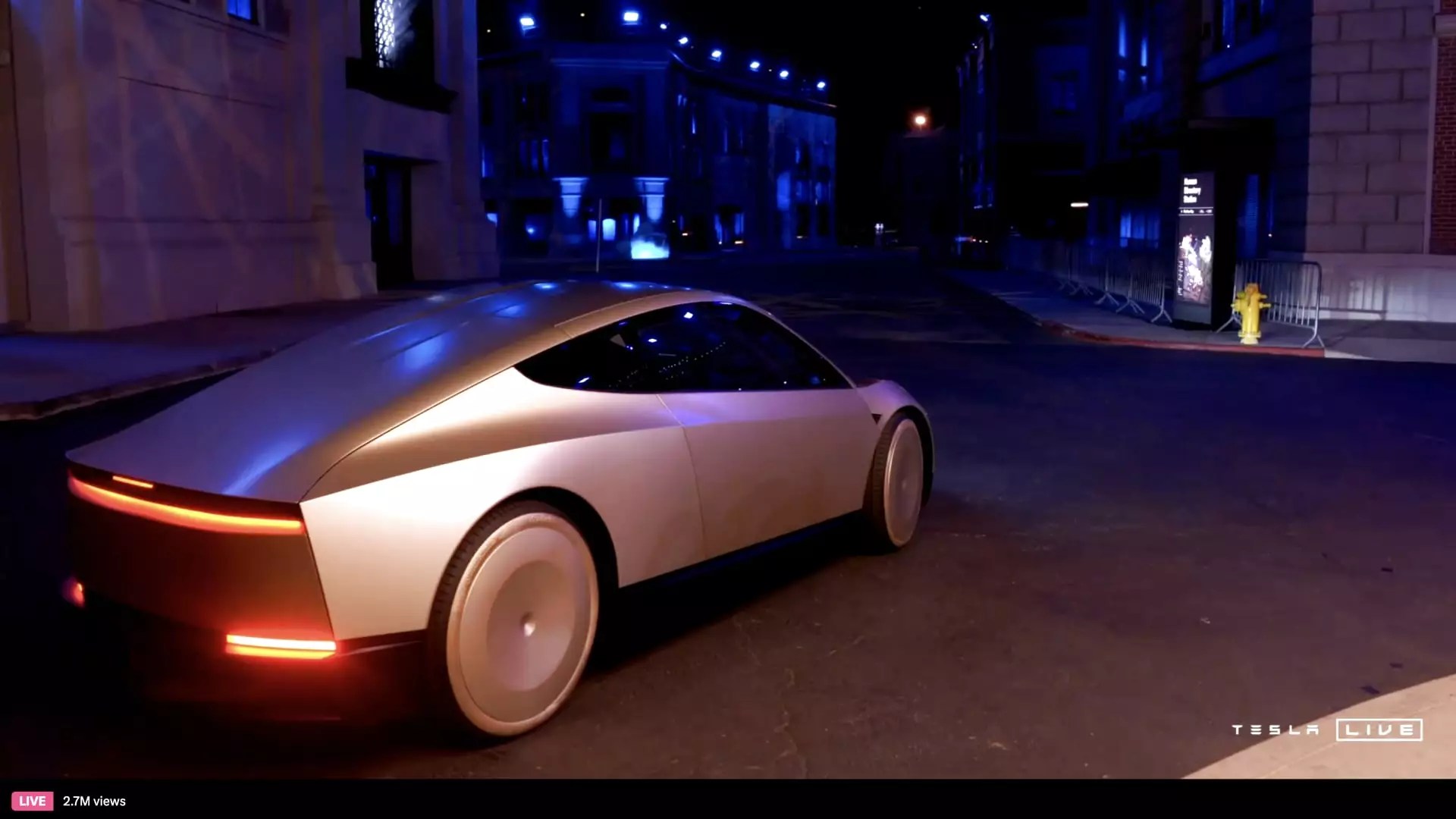

As anticipation built over weeks leading up to the robotaxi event, investors sought assurance that Tesla was progressing toward its promises of a self-sufficient transportation future. The unveiling of the Cybercab—a futuristic two-seater devoid of traditional driving controls—was expected to provide a glimpse into how Tesla would redefine urban mobility. Instead, Musk’s presentation largely focused on long-term ambitions, with scant details on operational plans or timelines for the Cybercab’s market introduction, which is projected for 2027. This lack of concrete information left many traders feeling disillusioned.

The initial stock reaction hinted at investor disappointment. A 5.8% decline in premarket trading was a clear signal that the market anticipated more than a conceptual rollout. Analysts highlighted the presentation’s failure to deliver tangible updates on immediate projects or pragmatic timelines for the much-touted Full Self-Driving (FSD) technology. Barclays noted this disconnect, calling attention to Tesla’s pattern of emphasizing visionary goals over actionable insights, which only deepened investors’ frustrations.

The Missing Pieces in FSD Technology

At the heart of the discourse surrounding Tesla’s future is its FSD system, which remains in a “supervised” testing phase. While Musk asserted that “unsupervised FSD” would be operational in Texas and California within a year, the details surrounding its launch were notably absent. Investors are longing for data demonstrating the system’s reliability and progression, yet no definitive metrics were provided during the event. Comments from Morgan Stanley underscored a broader disappointment, emphasizing a missed opportunity to showcase advancements and ridership economics that could solidify Tesla’s standing in the autonomous vehicle space.

Furthermore, the speculation regarding potential partnerships, such as a collaboration with Musk’s AI venture, xAI, was left unaddressed, leaving analysts puzzled about Tesla’s strategic direction. With competitors like Waymo successfully operating robotaxi services, Tesla’s hesitance to articulately navigate the intricate landscape of AI development raises questions about its long-term viability in a sector increasingly driven by technological sophistication.

Market analysts are now bracing for potential volatility in Tesla’s stock as pre-event enthusiasm wanes. Piper Sandler’s note articulated a belief that investor sentiment might sour, leading to further declines in share value in the coming weeks. This outlook reflects a broader concern: Tesla’s narrative that once captivated investors is eroding in light of unmet expectations. Without clear pathways to achieving its ambitious goals, Tesla risks being overshadowed by competitors that exhibit a more transparent and actionable approach to autonomous technology.

Looking ahead, Tesla faces a dual challenge: addressing investor confidence while also navigating the regulatory landscape surrounding self-driving cars. With safety concerns taking precedence, and self-driving technology still perceived as a nascent reality, the company’s path to mainstream acceptance appears fraught with hurdles.

While Tesla continues to be positioned at the pinnacle of electric vehicle innovation, the recent Cybercab event has inadvertently illuminated the gap between promise and execution. Investors, now more than ever, are scrutinizing the company’s roadmap for clarity and efficacy, underscoring the necessity for Tesla to bolster its reputation through transparency and realistic timelines. Only time will tell if Musk’s vision can translate into a sustainable reality amid rising expectations and competitive pressures.

Leave a Reply