Super Micro Computer, a prominent player in server manufacturing, has recently swung into the spotlight following its announcement of engaging BDO as its new auditor. This decision came on the heels of the company’s struggles with compliance and its commitment to regaining its standing on the Nasdaq exchange. The immediate market reaction has been one of optimism, with Super Micro’s shares soaring 23% in after-hours trading, illustrating the significant impact such corporate governance moves can have on investor confidence.

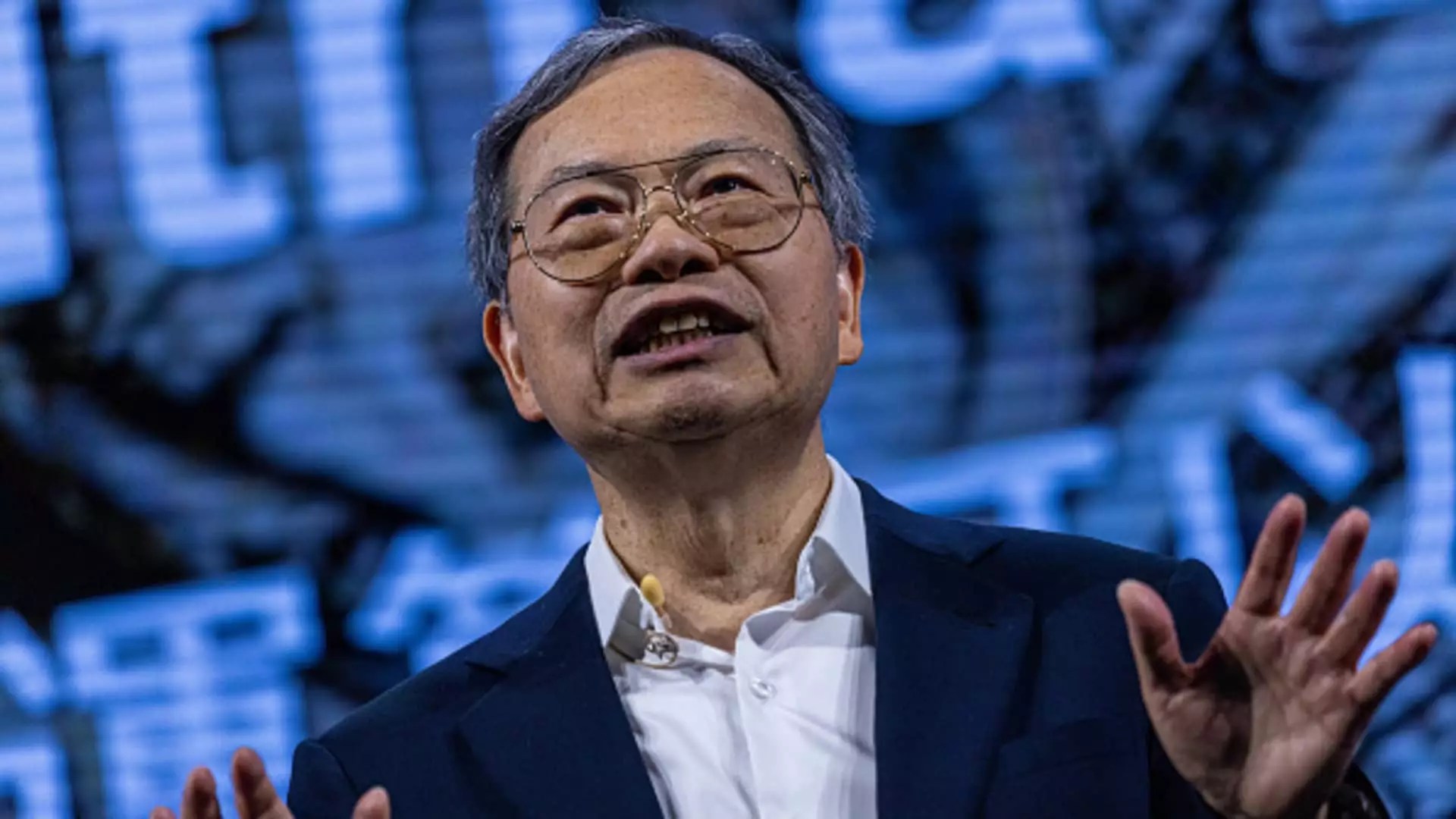

CEO Charles Liang emphasized the critical nature of this change by stating that it represents “an important next step” in their journey toward aligning their financial statements with regulatory standards. It is a declaration of intent to address the financial reporting delays that have plagued the company, which include the overdue filing of its 2024 year-end report with the SEC. This emphasis on “diligence and urgency” serves to reassure stakeholders that the company is fundamentally committed to restoring transparency and compliance after a turbulent phase.

Super Micro’s tumultuous journey into compliance has not been solely a matter of changing auditors. The company’s previous auditor, Ernst & Young, had taken over from Deloitte & Touche only a few months prior, indicating a sense of instability in its accounting departments. Following Ernst & Young’s resignation in October, Super Micro found itself in a precarious position regarding its financial obligations, ultimately leading to its notification from Nasdaq regarding compliance failures.

The company informed Nasdaq of its plans to submit its annual report for the period that ended on June 30, along with its quarterly report for September 30. Nasdaq’s review of Super Micro’s compliance plan will determine whether the company remains listed, an important factor for investors who had seen the stock hit highs amid the AI boom and then plunge due to regulatory setbacks.

Super Micro’s shares had experienced an unprecedented growth of over 20 times their value between early 2022 and March of the current year, making its valuation peak at about $70 billion. However, the compliance issues have caused a dramatic decline, now seeing the company’s market capitalization at only $12.6 billion. Despite the recent rally of 16% on the regular trading day, it is evident that confidence is wavering as shadows of potential financial malfeasance linger.

The recent announcements about the sale of products using Nvidia’s next-generation AI chips, named Blackwell, are indications that Super Micro remains a relevant competitor in the rapidly evolving AI landscape. Yet, the competition with major companies like Dell and Hewlett Packard Enterprise adds further pressure, not just to maintain innovative offerings but also to stabilize investor faith amidst compliance challenges.

An additional layer of complexity was introduced by the actions of Hindenburg Research, a notorious short seller that disclosed its short position in Super Micro and hinted at potential accounting manipulations backed by its report. The momentum of criticism has coupled with the scrutiny from regulatory bodies, as reports surfaced indicating that the Department of Justice is probing the company’s practices.

The months following Super Micro’s announcement of filing delays were characterized by increased investor uncertainty, leading to further stock decline. Reflecting on the rapid ascension and subsequent struggles of Super Micro, it is evident that market sentiment can shift swiftly based on compliance and governance.

As Super Micro works diligently to resolve its compliance issues, the industry and investors will be watching closely. The company’s performance in upcoming fiscal reports will serve as critical indicators of its direction, as the pressure mounts to regain trust in the wake of past missteps. Additionally, how well Super Micro can leverage its partnerships, particularly with Nvidia amid the AI surge, will be crucial to its recovery strategy.

Future success for Super Micro necessitates not just compliance and transparency but also resilient market positioning in an increasingly competitive environment. The next few months may prove pivotal, as the company strives to reclaim both its market position and investor confidence in a landscape that is still reeling from turbulence.

Leave a Reply