In a notable shift, Warren Buffett has been systematically reducing his stake in Apple Inc., highlighting a strategic pivot for Berkshire Hathaway. This marks the fourth consecutive quarter in which the conglomerate has trimmed its largest equity holding. As of September, Buffett’s remaining Apple shares were valued at approximately $69.9 billion, reflecting a significant reduction of about 67.2% from the previous year’s levels. Such a substantial decrease raises questions about the motivations behind this sell-off—whether it is a matter of rebalancing or a response to broader market conditions.

Buffett’s decision to divest a quarter of his stake, equivalent to around 300 million shares, has prompted considerable speculation in financial circles. Analysts have floated theories ranging from concerns over Apple’s valuation to a calculated move to mitigate investment concentration risks. Notably, there was a period when Apple’s shares represented half of Berkshire’s equity portfolio—a factor that may have compelled Buffett to reassess his commitment to such a dominant position. The instinct to diversify seems prudent, particularly in the wake of a volatile market environment.

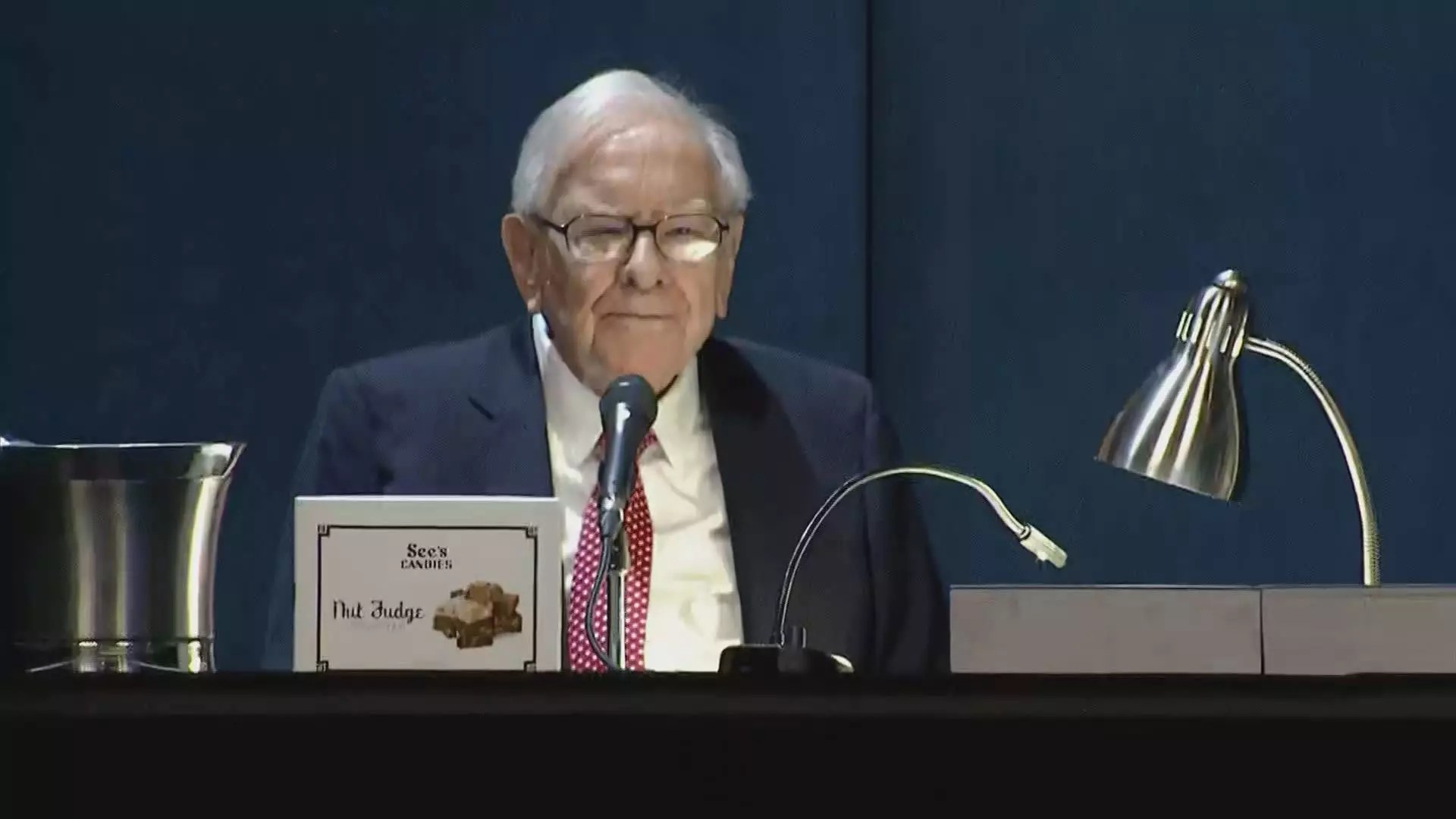

Buffett’s previous comments at the Berkshire annual meeting hinted at potential tax implications, suggesting that the prospect of rising capital gains taxes may have influenced his selling strategy. The investor’s seasoned foresight in recognizing impending fiscal changes illustrates a tactical approach to wealth management. However, some observers interpret the magnitude of the sell-off as indicative of deeper concerns, perhaps transcending mere tax strategy.

The journey of Buffett’s investment into Apple is a fascinating narrative in itself. Initially, Buffett had been hesitant about technology stocks, famously declaring them outside of his “circle of competence” for much of his investing career. His turnaround was influenced by investment lieutenants Ted Weschler and Todd Combs, and Apple quickly evolved into a cornerstone of Berkshire Hathaway’s portfolio after its initial purchase in 2016. The appeal of Apple’s robust customer loyalty and the outright dominance of the iPhone in the tech ecosystem cannot be understated; these factors contributed to Buffett labeling Apple as the second most significant business after his insurance operations.

As Berkshire’s Apple shares were thinning out, the company’s cash reserves reached an unprecedented $325.2 billion in the third quarter, an all-time high. This liquidity provides Buffett with immense flexibility for future investments, creating an intriguing backdrop for his strategic decisions. Notably, during this quarter, Berkshire ceased all buybacks, perhaps indicating a broader shift in strategy as they reevaluate their asset allocations.

Despite Buffett’s ongoing disposition of Apple shares, the stock itself has seen a 16% rise year-to-date, although this lags behind the S&P 500’s 20% gain, suggesting that while Apple remains a solid player in the market, its growth trajectory may not align with Buffett’s value investment philosophy at this time. As the market evolves, so too will Buffett’s strategies; it remains to be seen whether this approach signifies a temporary retreat or a long-term reconfiguration of Berkshire’s investment priorities.

Leave a Reply