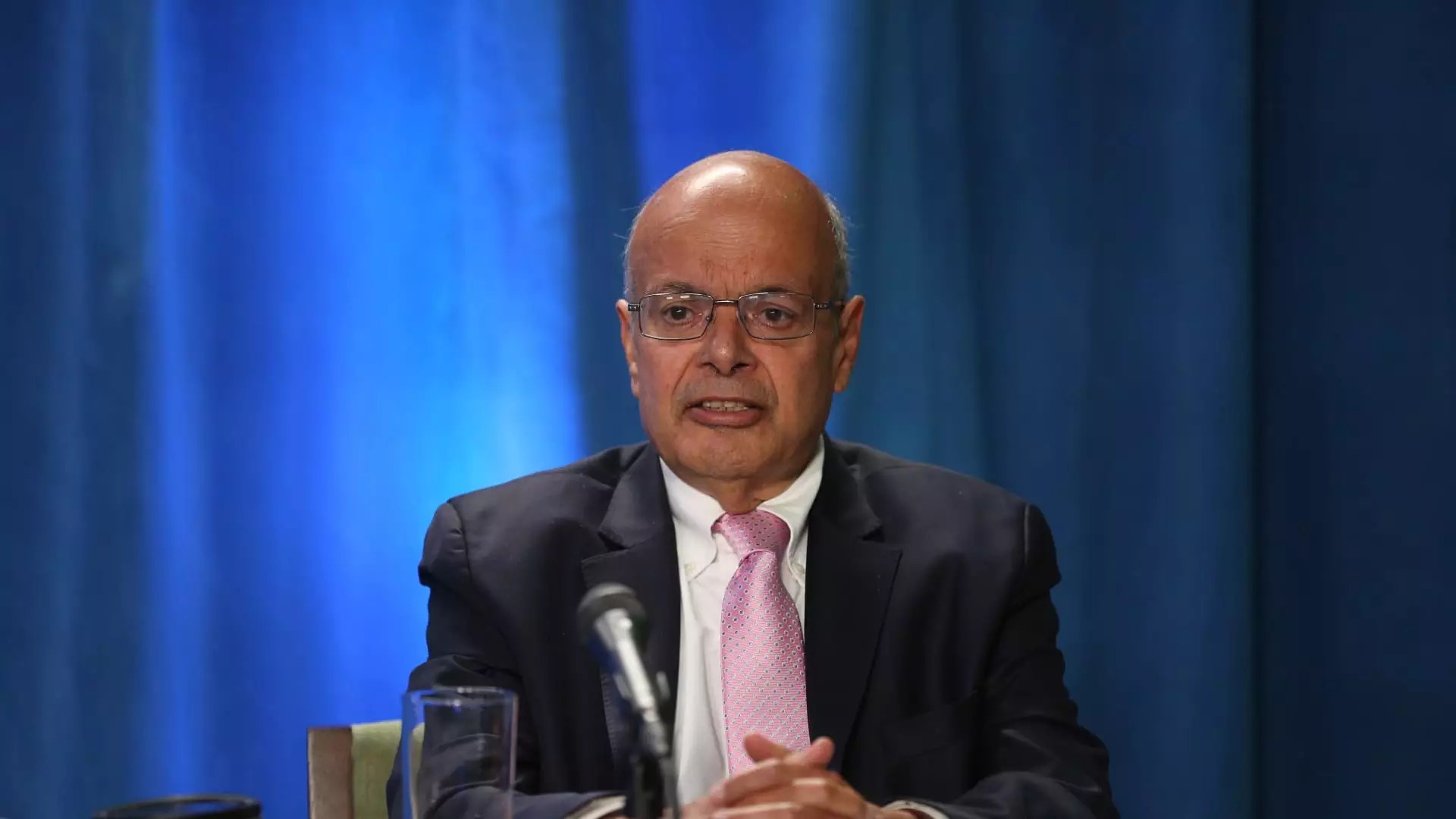

In a surprising move that has caught the attention of the investment community, Ajit Jain, who serves as Warren Buffett’s right-hand man in insurance operations at Berkshire Hathaway, has sold a significant portion of his holdings in the conglomerate. The regulatory filing revealed that Jain, at the age of 73, divested more than half of his stake, a decision that raises questions regarding the future direction of both Jain and the company he has helped steer since 1986.

On a recent Monday, Jain offloaded 200 Class A shares of Berkshire Hathaway at an average price close to $695,418 each, totaling around $139 million. This transaction left him with a mere 61 shares, while the family trusts linked to him and his spouse hold 55 shares, and his philanthropic Jain Foundation retains 50 shares. This sale signifies a dramatic shift; it constitutes 55% of his entire stake in Berkshire, marking the first substantial reduction in Jain’s assets since he joined the company nearly four decades ago.

The timing of this decision is noteworthy. The sale coincides with Berkshire Hathaway hitting impressive stock prices, recently trading above the $700,000 mark, a price that propelled the company’s market capitalization to an eye-popping $1 trillion by the end of August. Observers like David Kass, a finance professor at the University of Maryland, interpret this move as a potential signal from Jain, indicating that he believes the shares are currently fully valued.

The implications of Jain’s actions could extend beyond personal finance and into broader market perceptions. As noted by Bill Stone, Chief Investment Officer at Glenview Trust Co., the sale may send a message regarding the valuation of Berkshire’s stock. At approximately 1.6 times its book value, Berkshire Hathaway seems to be trading around Buffett’s own conservative estimates of intrinsic value. Stone’s perspective creates an environment of skepticism about future stock buybacks, which have already seen a slowdown—from $2 billion in the previous quarters to only $345 million in the second quarter.

This reduced share repurchase activity may reflect a broader trend within Berkshire, indicating that even the majestic conglomerate considers its stock to be overvalued in the current market. As investors keep a close eye on these changes, the focus will now shift to how Berkshire Hathaway decides to utilize its capital moving forward.

Perched at the helm of Berkshire’s insurance operations, Jain has been instrumental in the company’s resurgence and success. His pivotal role in expanding the company’s footprint into the reinsurance industry and revitalizing its flagship auto insurance venture, Geico, has earned him high praise from Buffett himself. In his 2017 annual letter, Buffett lauded Jain for creating “tens of billions of value” for shareholders, emphasizing the exceptional impact Jain has had on the company’s fortunes.

Despite whispers that Jain might be in contention to lead the company in the future, Buffett recently clarified that Jain has never expressed a desire to run Berkshire and that there is no competitive dynamic between him and Greg Abel, who has been named Buffett’s eventual successor. This clarity dispels speculation about leadership, but it does put a brighter focus on Jain’s current financial maneuvers, raising questions about his long-term vision and objectives.

Ajit Jain’s decision to sell a considerable portion of his Berkshire Hathaway holdings is a layered development that merits thoughtful analysis. While on one level, it could represent a personal financial strategy in reaction to market conditions, on another, it may reflect a more cautious outlook on the stock’s future performance. The fact that someone of Jain’s stature and experience has chosen to reduce his ownership stake does not go unnoticed in the investment community.

As stakeholders consider the underlying motivations and future implications of Jain’s actions, it remains crucial to monitor how this might influence perceptions of Berkshire Hathaway at large. The reverberations of this sale may continue to shape investor sentiment as they seek to understand the shifting dynamics within one of the most storied conglomerates in American business history.

Leave a Reply