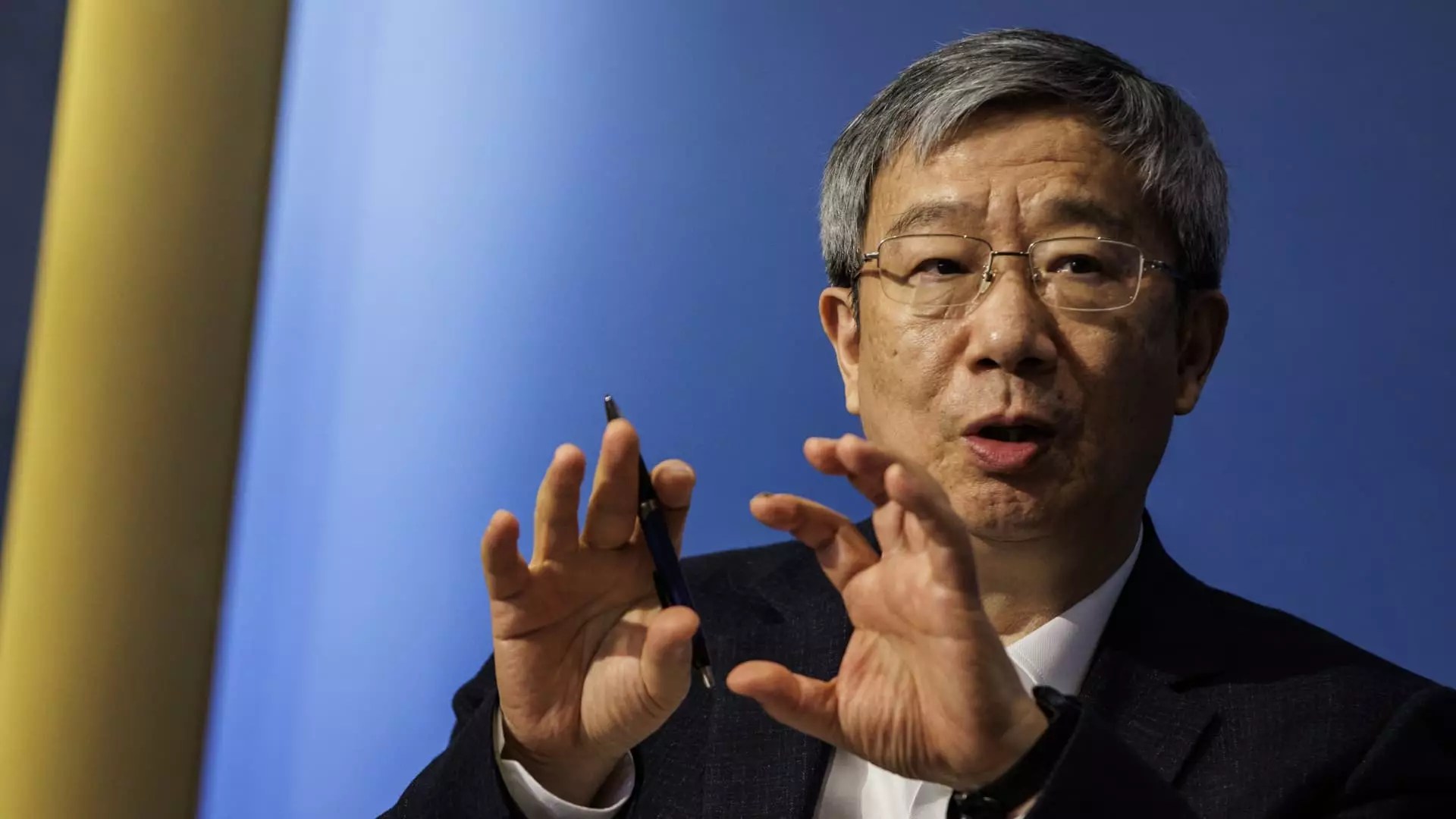

China’s policymakers are currently facing the challenge of boosting domestic demand in order to combat deflationary pressures. Former head of the People’s Bank of China, Yi Gang, emphasized the need for proactive fiscal policy and accommodative monetary policy to address the lackluster domestic demand. This is crucial in light of falling consumer prices in 2023 and marginal growth in the following year, which has impacted the economy.

Yi Gang highlighted the importance of improving domestic demand by addressing key issues such as the real estate market and local government debt. These aspects play a significant role in influencing societal confidence and overall economic growth. It is essential for policymakers to implement strategies that will stabilize the real estate market and mitigate the local government debt problem to boost domestic consumption.

The People’s Bank of China has various monetary policy tools at its disposal to stimulate the economy. Zou Lan, director of the PBoC’s monetary policy department, mentioned the possibility of lowering the reserve requirement ratio to increase the amount of cash available to banks. This, coupled with other monetary policy measures, can help support consumption and investment in the economy.

Despite efforts to bolster the real estate market, sales and investment in new properties have continued to decline. Managing the housing crisis remains a major challenge for Chinese policymakers as they strive to maintain economic growth and ensure sufficient domestic demand. The impact of the real estate market slump on consumer sentiment and future income uncertainty has contributed to the overall economic slowdown.

Haruhiko Kuroda, former head of the Bank of Japan, emphasized the importance of avoiding prolonged deflation, even if mild, as it can hinder wage determination. Drawing parallels with Japan’s 15-year deflationary period, Kuroda highlighted the negative impact it had on wage growth. Chinese policymakers must learn from Japan’s experience and take proactive measures to prevent a similar situation in their economy.

The focus on boosting domestic demand is crucial for China’s economy to overcome deflationary pressures and stimulate growth. Policymakers need to address issues in the real estate market, local government debt, and consumer sentiment to create a conducive environment for economic recovery. By implementing proactive fiscal and monetary policies, China can navigate through the current challenges and achieve sustainable economic growth in the long run.

Leave a Reply