Contemporary Amperex Technology Co., Limited (CATL) is no longer content to be merely a leading producer of car batteries; it is carving out a broader, more ambitious territory—one defined by the integration of software, artificial intelligence, and strategic licensing. This bold shift reflects the company’s understanding that the future of energy storage and mobility does not rest solely on hardware innovations but increasingly depends on creating ecosystems that merge hardware with intelligent, value-added services.

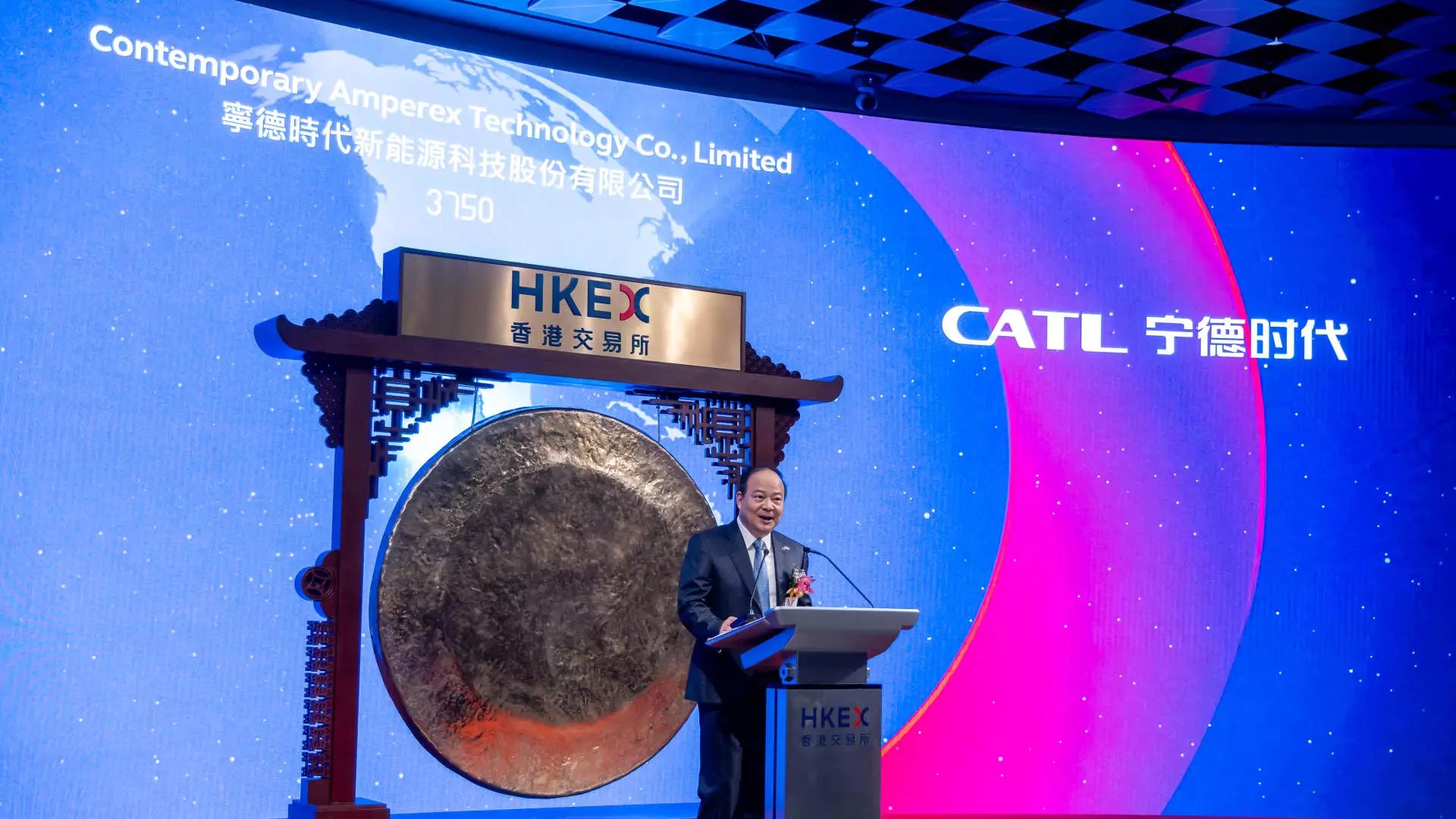

While many have fixated on CATL’s recent IPO success and its dominance in the electric vehicle supply chain, this company’s aspirations extend far beyond simple manufacturing. Analysts now perceive CATL as a potential ecosystem powerhouse—one capable of leveraging its technological prowess to shape a competitive landscape that will challenge traditional automotive and energy titans. Such a perspective indicates a profound recognition of the convergence between hardware, AI, and licensing, positioning CATL to influence the global supply chain, geopolitical relations, and economic policies.

This is not just about profits; it’s about strategic dominance. The company is proactively building an integrated platform that could revolutionize how batteries are monitored, managed, and monetized, especially through advanced AI-powered tools that enhance safety, performance, and reliability. Such developments could ultimately lower costs and boost consumer confidence, thereby cementing CATL’s competitive edge in burgeoning markets. From this angle, the broader implications threaten existing industrial hierarchies, compelling established automakers and policymakers to reconsider their alliances and strategies.

Strategic Licensing and Geopolitical Risks: A Double-Edged Sword

CATL’s move toward licensing agreements, exemplified by its partnership with Ford, highlights a shrewd strategic maneuver that balances expansion with geopolitical prudence. As the company prepares to license its battery technology for Ford’s Michigan factory, it must navigate the treacherous waters of U.S. national security concerns. The U.S. Department of Defense’s decision to add CATL to a “Chinese military” list underscores the geopolitical chess game that now underpins global technology supply chains.

This tension reveals the inherent paradox within CATL’s expansion: on the one hand, it seeks to diversify revenue streams and grow into international markets like Europe and Southeast Asia; on the other, it faces severe restrictions that could hinder access to critical markets and funding. While companies like Morgan Stanley and Bank of America remain optimistic about CATL’s prospects, their optimism often hinges on assumptions that geopolitical risks are already priced into the company’s valuation.

The fact that CATL continues to push into regions like Hungary and Indonesia evidences a desire to circumvent trade barriers and diversify supply chains—yet, the looming threat of sanctions and restrictions suggests that the company’s geopolitical footprint is a double-edged sword. It is poised to benefit from global demand for batteries but remains vulnerable to geopolitical headwinds that could distort supply, inflate costs, or limit access to critical markets.

The Future of Power: Innovation, Ecosystems, and Market Control

CATL’s strategic positioning reveals an intent to transition from being a commodity supplier to a provider of integrated solutions—a move that could redefine industry standards and reshape competitive advantages. Its focus on developing AI-driven battery monitoring, safety solutions, and licensing deals signals an understanding that in the modern economy, innovation isn’t confined to product lines but extends into business models and ecosystems.

This shift is both an opportunity and a threat. If successful, CATL could dominate the entire battery supply chain, from raw materials to end-user software solutions, consolidating power in a manner that rivals the influence of traditional automakers and tech conglomerates. The company’s investments in European factories and battery recycling initiatives underscore its long-term plan to secure global market share, but they simultaneously expose it to regulatory and political risks that could temper its ambitions.

Additionally, partnerships with automakers like Zeekr and Xiaomi point toward a future where batteries are more integrated into a variety of mobility and consumer products, creating new revenue streams and locking in customers. The move into hybrid and battery swapping technologies signifies an understanding that the energy landscape is shifting toward multifunctionality, with flexibility and adaptability becoming key competitive factors. Ultimately, CATL’s ability to innovate and expand without succumbing to geopolitical and economic barriers will determine whether it transforms into an autonomous power hub or becomes a pawn caught in larger geopolitical conflicts.

The Center-Right Perspective: A Critical View on Tech Hegemony and Economic Sovereignty

From a center-right liberal outlook, CATL’s ascendancy raises important questions about balancing technological sovereignty with global market integration. While innovation and free enterprise are vital, unchecked dominance by any single company or nation risks creating dependencies that could threaten national economic security and policy autonomy.

The U.S. government’s concerns about CATL—its inclusion on a military-related blacklist—highlight the dangers of allowing geopolitical tensions to intertwine with economic interests. While free markets should facilitate growth and innovation, strategic industries such as battery technology—and the surrounding ecosystem—must be cultivated with a keen eye toward safeguarding national interests, fostering competition, and preventing monopolistic behaviors.

Furthermore, the emphasis on licensing and ecosystem development should not obscure the importance of maintaining open, secure, and equitable trade practices. The pursuit of global expansion must be critically evaluated against the backdrop of strategic autonomy, ensuring that technological leadership does not morph into dependency or strategic vulnerability.

CATL’s trajectory showcases a company’s ability to leverage technological evolution and geopolitical navigation into a potential global dominance. However, unrestrained pursuit of technological supremacy and market expansion without a balanced, sovereign-minded approach risks undermining the very freedoms and strategic interests that underpin a resilient, center-right liberal economy.

Leave a Reply