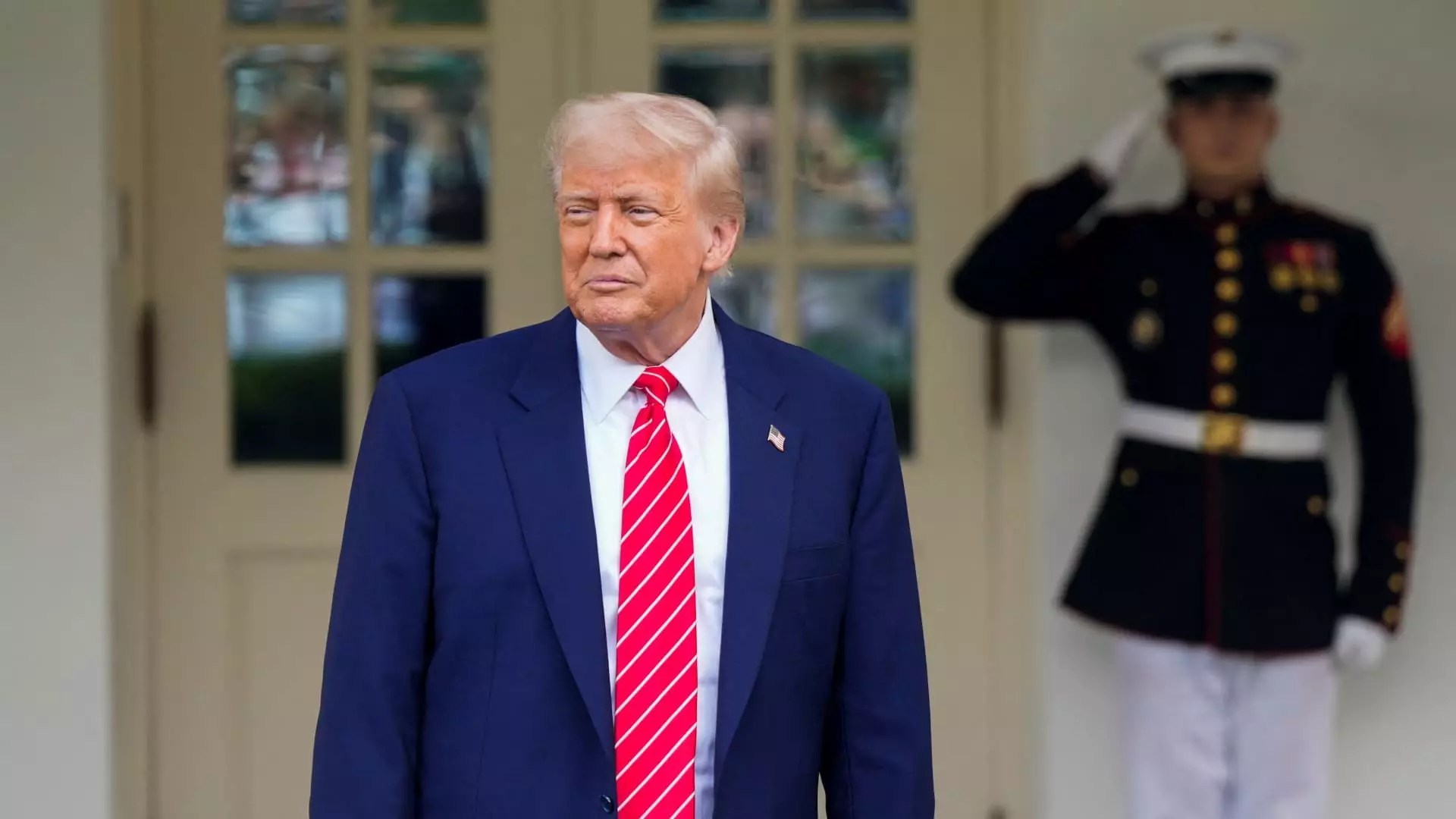

Donald Trump’s ongoing association with various cryptocurrency projects, particularly his own ventures, has raised significant alarms in the political and financial realms. This isn’t merely a problem of partisanship; it fundamentally erodes the governance structures meant to create a transparent framework for digital currencies. When lawmakers attempted to pass the GENIUS Act—legislation designed to provide rigorous regulations for stablecoins—they were faced with a major obstacle: Trump’s financial entanglements. Several legislators voiced concerns about his potential conflicts of interest as they recognized that individuals aiming to curry favor with the president may unintentionally boost his personal wealth by investing in cryptocurrencies he owns. This cringe-worthy situation further complicates the already tangled web of crypto legislation and, frankly, paints a picture of governance that feels more like crony capitalism than public service.

Bipartisan Support Thwarted by Self-Interest

For a fleeting moment, it seemed possible that bipartisan support could unite behind a framework that many recognized was essential for stabilizing the usually tumultuous world of cryptocurrency. Yet, as demonstrated by the failure of the GENIUS Act to garner the necessary votes, personal gains took precedence over public service. Several Senate Democrats who had once supported the bill suddenly classified Trump’s financial activities as detrimental to the national interest. With such clear-cut evidence of self-dealing, is there any wonder that trust in political institutions is waning? The perception is that Trump’s ventures are not merely business activities; they are tactics used to manipulate legislative processes for personal enrichment.

The Dangerous Precedent of ‘Pay-for-Play’ Schemes

In many ways, Trump’s involvement with meme coins such as $TRUMP and $MELANIA has set a dangerous precedent that other politicians might be tempted to follow. This “pay-for-play” style of governance, most recently highlighted through promotional dinners to incentivize crypto purchases, raises critical ethical questions. The very notion of leveraging the presidency for personal financial gain challenges our constitutional norms and creates a slippery slope in which those in power may view their positions more as business opportunities than public trusts. Calls from lawmakers, including Sen. Blumenthal, for a robust investigation into Trump’s crypto ventures emphasize the urgent need to safeguard political processes from this encroaching influence of personal profit.

The Urgency for Regulatory Clarity

The failure of coherent and comprehensive regulations leaves a vacuum that could potentially destabilize both investors and the broader economy. With various factions of lawmakers like Sen. Gillibrand advocating for stringent stablecoin regulations while others raise the alarm about the integrity of the financial system, the need for consensus has never been more pressing. Trump’s personal investment portfolio in the crypto realm is a ticking time bomb that threatens to overshadow these crucial discussions. This duality of interests makes it increasingly challenging to advocate for policies that genuinely benefit American consumers. The inability to separate personal and public interests not only jeopardizes legislative importance but also threatens to tarnish the image of the American crypto industry on a global scale.

Innovation at Risk Amid Personal Agendas

The current landscape surrounding cryptocurrency policy is riddled with hurdles stemming from Trump’s self-interested dealings. As stakeholders within the crypto community eagerly await long-overdue regulatory clarity, they face a significant impediment: the very person who should champion technological innovation is instead bogged down by personal interests. Ryan Gilbert, a notable figure in fintech, aptly highlighted the frustration that many investors are feeling—good policy is obstructed by personal pursuits. This scenario is not just unfortunate; it’s damaging to our entire financial ecosystem, particularly at a time when the United States is trying to remain competitive in the global digital currency arena.

A Crisis of Confidence

As scrutiny over Trump’s crypto dealings escalates, it’s important to reflect on what this all means for both the political climate and the nation’s economic wellbeing. If faith in elected officials continues to erode, it stands to reason that investors, both domestic and international, will think twice before investing in U.S. concepts. Calls for investigations surrounding Trump’s financial maneuvers are not just partisan hits; they are cries for accountability in a system replete with contradictions. The irony is painful: the one person in a position to revolutionize policy and regulation is instead mired in a potential ethics catastrophe that jeopardizes not only American interests but the future of innovation in cryptocurrency. As the crypto market has the potential to reshape our economy, the fear is that those in charge are too distracted, self-interested, or simply indifferent to make meaningful strides forward.

Leave a Reply